Step-by-step description of how to get a Tax report in Shopify

A Tax Report implies a document made by lawful subjects that characterizes their income taxes recorded in accordance with regulations.

Revealing the charge data is an ordinarily requirement for associations to provide information on all sorts of monetary exchanges made throughout their direct or related business. These exchanges can, for instance, be wage and non-wage installments.

This documentary space of tax announcing and obligation for it is persistently developing, conveying countless administrative requirements set up by the public authority of the country the store operates in.

There are presently several data reports on taxes needed by the public authority, and these documents ought to have the option to pass the cross-checking process that the duty specialists of the state may organize to verify the exactness of the announced assessment forms recorded by the business.

Report on taxes is generally identified with your business operations, customers, and the resources your business administers.

As an owner of a business endeavor that operates online, a legal requirement may be existing to charge additional sums on every deal conducted in the shop to cover tax expenses.

Depending on the legal requirements in a specific region, a store may have an obligation to prepare on a timely basis a report on those taxes and dispatch those expenses to the corresponding authoritative administration.

Typically, the tax report on sales incorporates all financial transactions in the store during the predefined time frame. It's a non-generic report, so it may contain data that isn't required for the tax return.

The report uses the time frame that is set for tax dispatching in your local area. Usually, any tax reporting tool allows you to see not only the current data on taxes but can also change the dates to see taxes on deals for different periods. Run the tax report generation to assemble data for documenting your business taxes and providing this data to the authorities.

The report on sales tax may typically include two main sections. One is the summary of sales tax, and the other is the Sales Tax Audit report.

The Sales Tax Summary shows a rundown of taxed deals in your store. They can be coordinated by the tax rate or type.

The Sales Tax Audit shows a rundown of your business tax transactions for the time frame designated to claim tax returns. The report uses the tax settings and tax rates of your business that were applied to taxes for the specified period.

Since taxes in the tax report are related to purchases and product returns, taxes can be depicted as a negative number. The tax value will be a positive number for any deal on the specified date that a customer made his order. It will be presented as a negative number when the purchased product was returned, and the deal was refunded by the store.

Shopify provides tax reports; however, this eCommerce platform does not document or dispatch your tax report to the corresponding authorities. You may have to enlist your business with your government or tax authority to deal with your business taxes.

The tax estimations and reports that Shopify gives to a store in the admin panel should assist with keeping things on taxes simpler when it's time to put your tax assessments on the official record.

Despite the fact that tax laws and tax guidelines are complicated and can change frequently, you can configure your Shopify sales tax report generating tool to naturally deal with many basic estimations on taxes. You can likewise set up custom reports on taxes to address extraordinary tax assessment laws and circumstances.

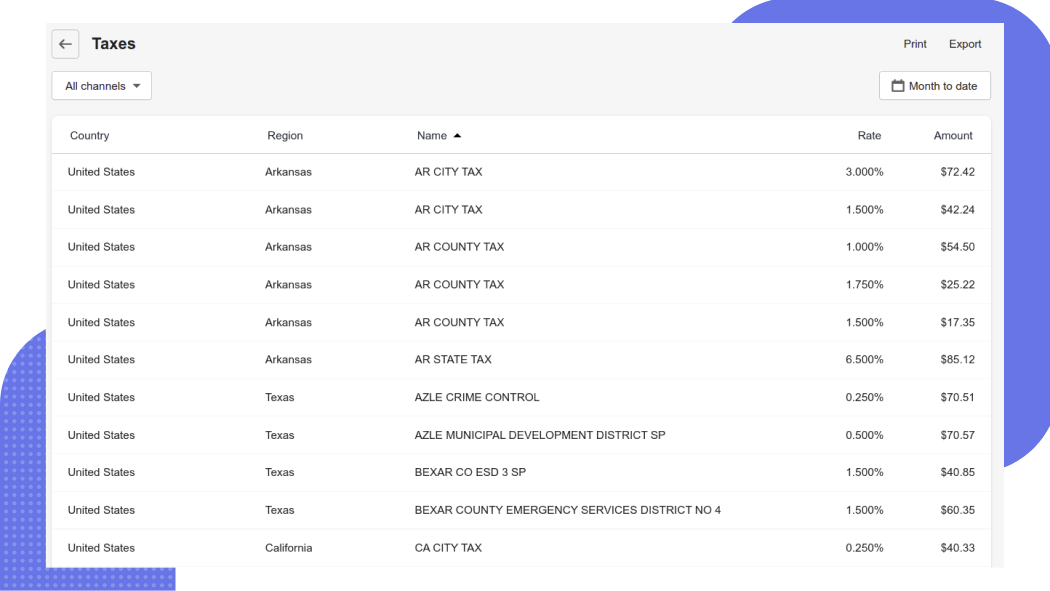

To get a Shopify Tax Report, you need to go to Analytics > Reports in the admin panel of your Shopify store and select Taxes in the Finance section.

The Tax report from Shopify depicts the statistics on deals and corresponding taxes that were applied to those deals in the chosen time period. Each column of the Sales Tax report Shopify provides shows a type of the tax. For example, it can be a local tax. The Shopify report for tax also shows its rate and the aggregated sum of expense that was charged during this time period.

The report for sales tax Shopify provides can be viewed as a total for the store and by individual sales channels, like an online store, Facebook sales channel, Shopify point of sale, etc. Additionally, you are free to choose the date range for tax report generation.

You can select one of the predefined date range values, for example, the last 90 days, month to date, year to date, and a quarter. Alternatively, you can choose an individual time range.

Since taxes are region-dependent, the tax report Shopify provides selects the nation and locale-dependent on the final location of the purchases. So it may show objective data in any event, even for cases of sales to locations that charge sales tax based on origin.

The final destination for every purchase is chosen based on its specified shipping address. In case it is not set up, the billing address is used for the purpose of determining the region. When both shipping and billing addresses are not available, Shopify uses point-of-sale addresses to determine the tax rates.

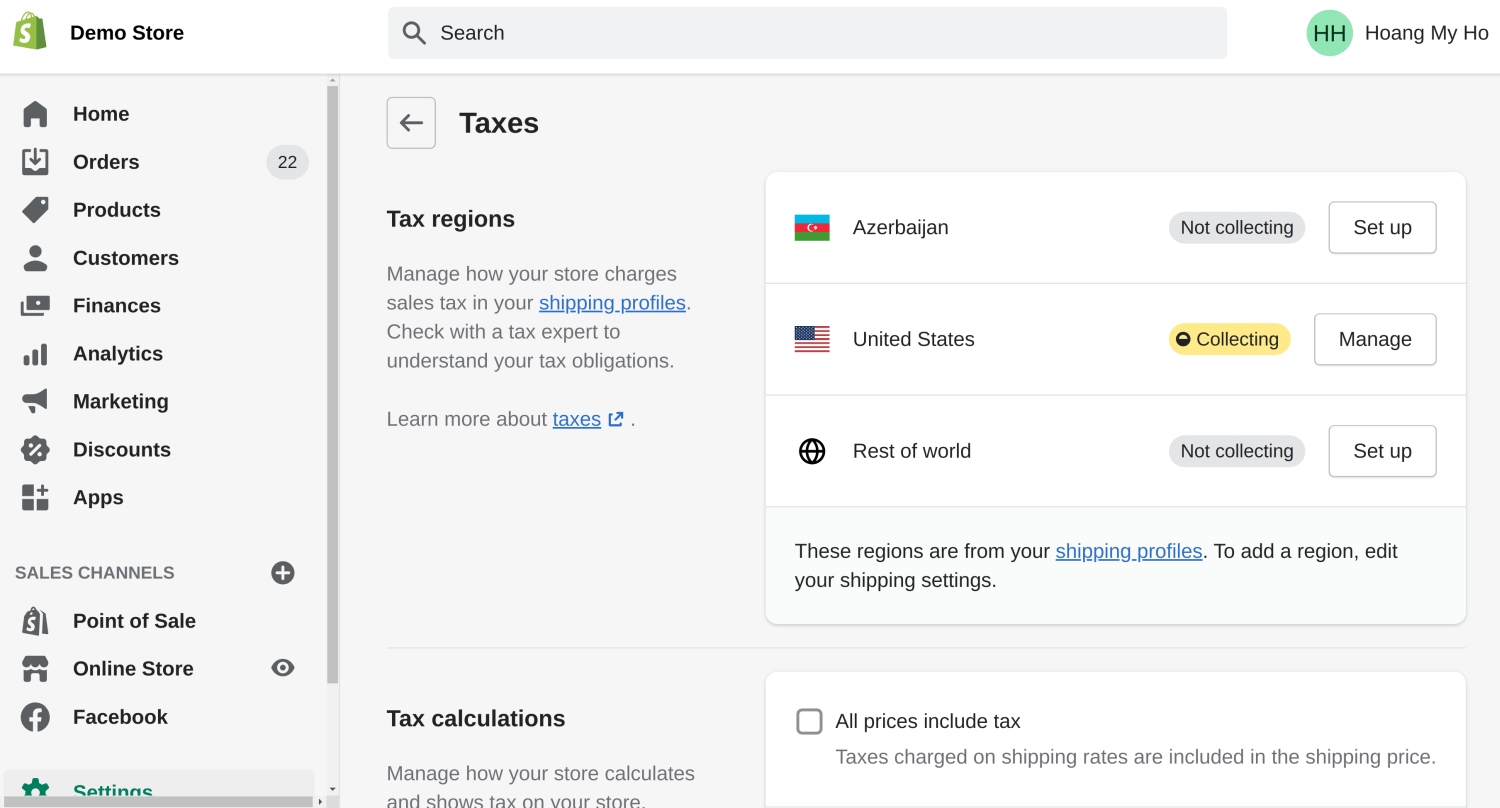

Online store owners should start configuring taxes in their stores by setting up the list of countries they ship products to. This is done by using the shipping zones functionality.

In your Shopify admin panel, locate the Settings section and open the Shipping and delivery page. On this page create a new shipping zone, which is a country that you need to configure taxes for.

Return to the Settings page and locate the Taxes section.

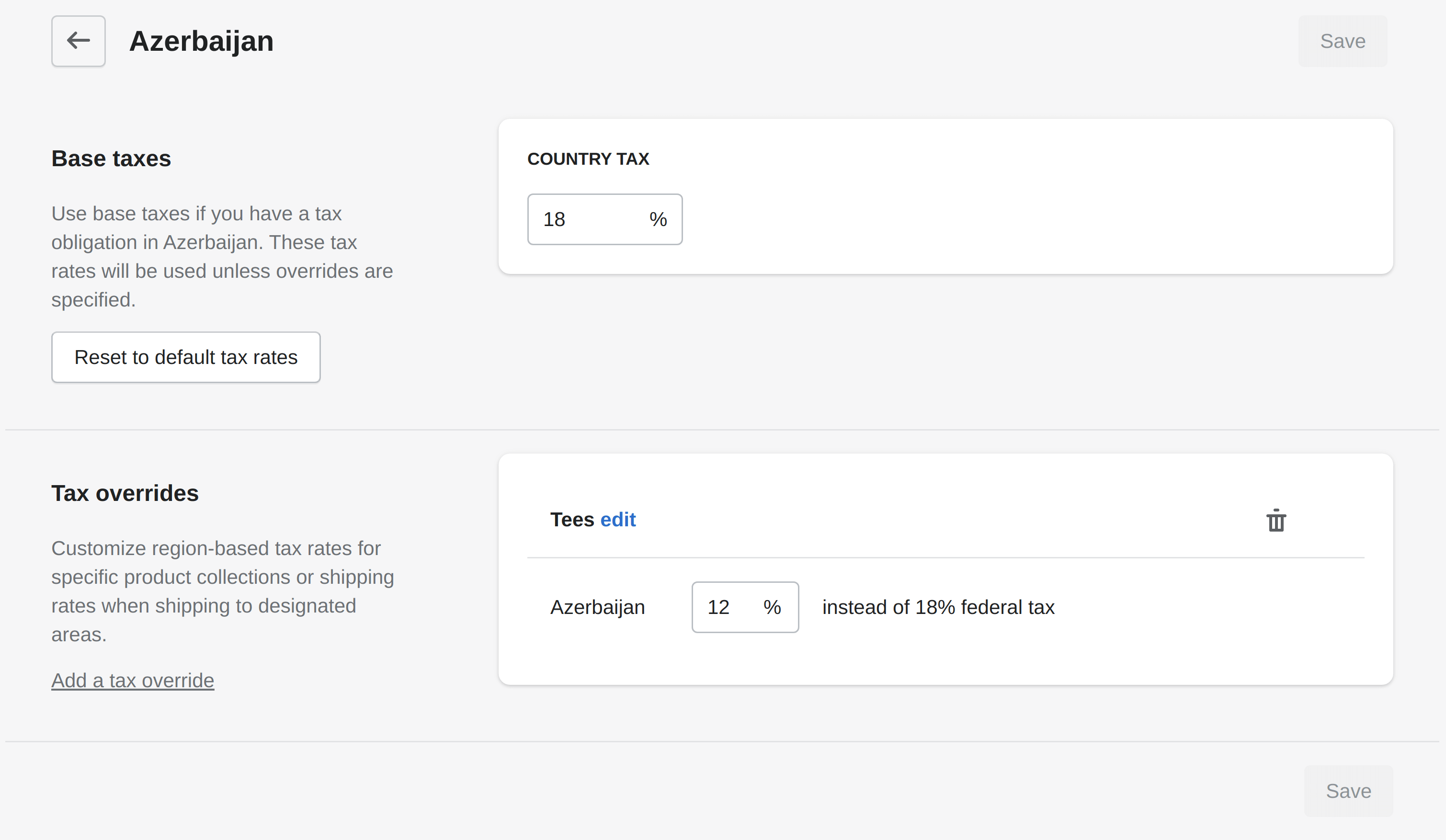

In the Tax Regions section locate the country you need to configure tax rates. Click the Manage button to open the tax configuration page. On this page specify the base tax rate and the tax override. The latter is a customized tax rate that can be used for specific product collections to override the base tax rate.

Such countries as the US, Canada, European Union, United Kingdom, Norway, Switzerland, Australia, New Zealand use taxes based on the registration. At that point, enter into Shopify the duty enrollments to gather taxes in your store.

For countries that use taxes based on location, you may use the default Shopify values or set the rates of a specific country or its region.

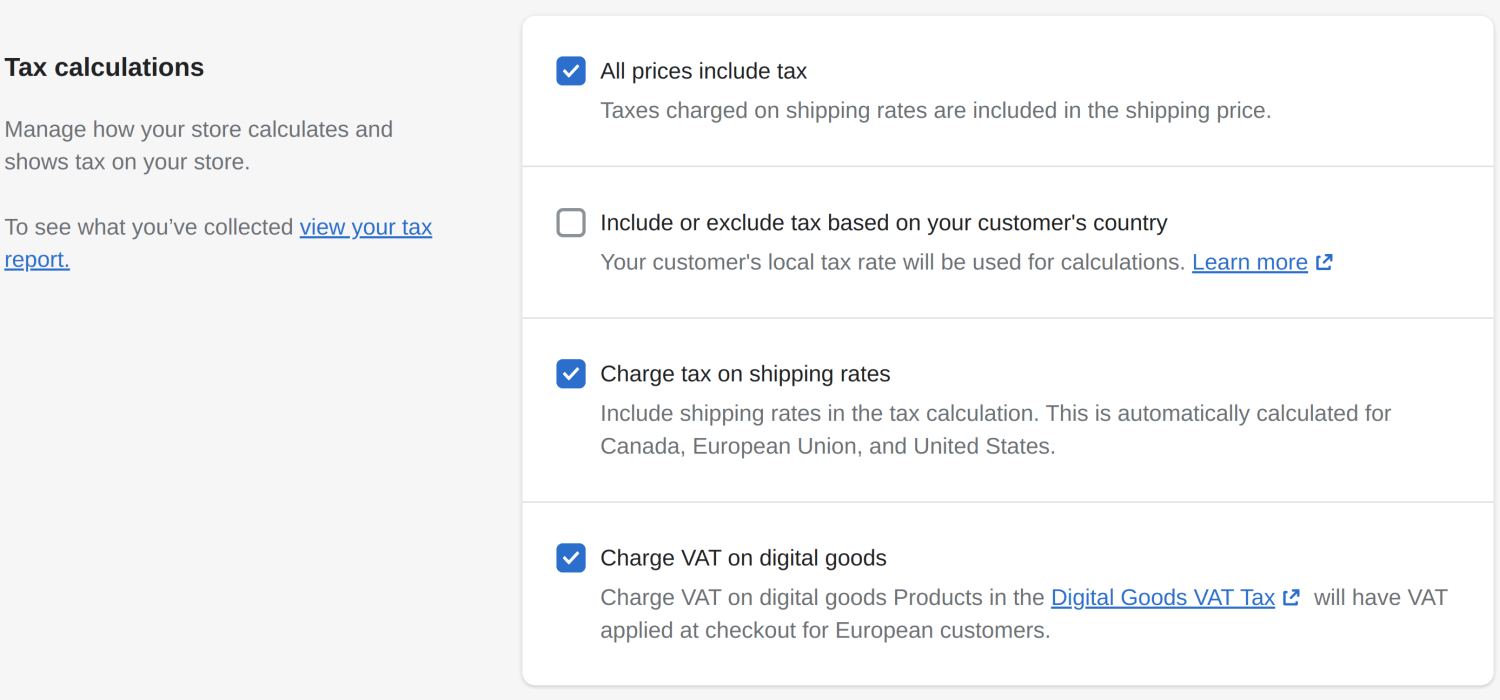

Keep in mind that some regions, like the European Union, require taxation of digital products. Such items are taxed regardless of the seller's location.

Other regions, like the United Kingdom, require that prices displayed on its frontend include taxes. To configure your Shopify in that way, in the admin panel of your store, go to Settings > Taxes and in the section Tax calculations activate the option All prices include tax.

To use the local tax rate of the country your customer is located at, you can use the option Include or exclude tax based on your customer's country.

Additionally, your store may be required to charge taxes on shipping. For stores that operate in Canada, US, EU, UK, Australia, New Zealand, the tax on shipping is calculated automatically. Stores that operate outside those countries, in this case, should activate the Charge tax on shipping rates option.

Learn more about tax peculiarities in specific countries on the Shopify help page on taxes.

Shopify presents very concise and general tax information. Therefore, if you need more accurate reports, then you can get them using our Advanced Reports app. You can also get faster access to tax reports with our app. Simply pin it to the reporting dashboard.

In addition to the general tax report, similar to that of Shopify, we offer more detailed reports, such as:

State / Provincial Tax, in which the report is based on the State / Province of the recipient

| OrdersCountry | OrdersProvince | OrdersNumber of orders | Order ItemsTotal Quantity | OrdersNet amount | Order Item TaxesTitle | Order Item TaxesTotal Tax Amount |

|---|---|---|---|---|---|---|

| United States | Alabama | 2 | 3 | $260.00 | AL STATE TAX | $0.00 |

| United States | Alaska | 1 | 4 | $131.75 | AK STATE TAX | $0.00 |

| United States | Arizona | 15 | 74 | $3,964.98 | AZ CITY TAX | $72.18 |

| United States | Arizona | 15 | 74 | $3,964.98 | AZ COUNTY TAX | $0.00 |

| United States | Arizona | 15 | 74 | $3,964.98 | AZ STATE TAX | $207.94 |

| United States | Arkansas | 4 | 15 | $711.23 | AR STATE TAX | $0.00 |

| United States | California | 13 | 40 | $2,375.58 | ALAMEDA COUNTY DISTRICT TAX SP | $73.12 |

| United States | California | 82 | 273 | $13,617.48 | CA CITY TAX | $94.41 |

| United States | California | 303 | 954 | $48,911.68 | CA COUNTY TAX | $116.10 |

| United States | California | 16 | 54 | $2,693.69 | CA SPECIAL TAX | $25.72 |

| United States | California | 303 | 954 | $48,911.68 | CA STATE TAX | $2,769.84 |

| United States | California | 6 | 15 | $654.81 | CONTRA COSTA COUNTY DISTRICT TAX SP | $9.49 |

| United States | California | 2 | 6 | $430.68 | FRESNO COUNTY DISTRICT TAX SP | $2.83 |

| United States | California | 2 | 4 | $0.00 | HUMBOLDT COUNTY DISTRICT TAX SP | $1.02 |

| United States | California | 1 | 3 | $98.37 | INYO COUNTY DISTRICT TAX SP | $0.53 |

| United States | California | 287 | 900 | $46,217.99 | LOS ANGELES CO LOCAL TAX SL | $435.94 |

| United States | California | 123 | 368 | $19,515.76 | LOS ANGELES COUNTY DISTRICT TAX SP | $407.62 |

| United States | California | 9 | 35 | $2,088.22 | MARIN COUNTY DISTRICT TAX SP | $14.18 |

| United States | California | 3 | 20 | $1,259.83 | MONTEREY COUNTY DISTRICT TAX SP | $5.76 |

| United States | California | 2 | 2 | $137.92 | NAPA COUNTY DISTRICT TAX SP | $1.06 |

| United States | California | 1 | 3 | $106.88 | NEVADA COUNTY DISTRICT TAX SP | $0.20 |

| United States | California | 21 | 55 | $2,581.68 | ORANGE COUNTY DISTRICT TAX SP | $13.01 |

| United States | California | 2 | 29 | $451.13 | RIVERSIDE COUNTY DISTRICT TAX SP | $2.06 |

| United States | California | 6 | 12 | $429.50 | SACRAMENTO COUNTY DISTRICT TAX SP | $2.04 |

| United States | California | 1 | 4 | $244.77 | SAN BERNARDINO COUNTY DISTRICT TAX SP | $0.52 |

| United States | California | 30 | 91 | $5,030.32 | SAN DIEGO COUNTY DISTRICT TAX SP | $23.04 |

| United States | California | 30 | 104 | $5,709.11 | SAN FRANCISCO COUNTY DISTRICT TAX SP | $68.95 |

| United States | California | 8 | 21 | $1,021.09 | SAN MATEO COUNTY DISTRICT TAX SP | $20.54 |

| United States | California | 5 | 18 | $700.14 | SANTA BARBARA COUNTY DISTRICT TAX SP | $2.22 |

| United States | California | 13 | 43 | $2,335.36 | SANTA CLARA COUNTY DISTRICT TAX SP | $46.04 |

| United States | California | 3 | 8 | $330.76 | SANTA CRUZ COUNTY DISTRICT TAX SP | $4.49 |

| ... | ... | ... | ... | ... | ... | ... |

| 1008 | 3156 | $165,009.88 | $9,058.23 |

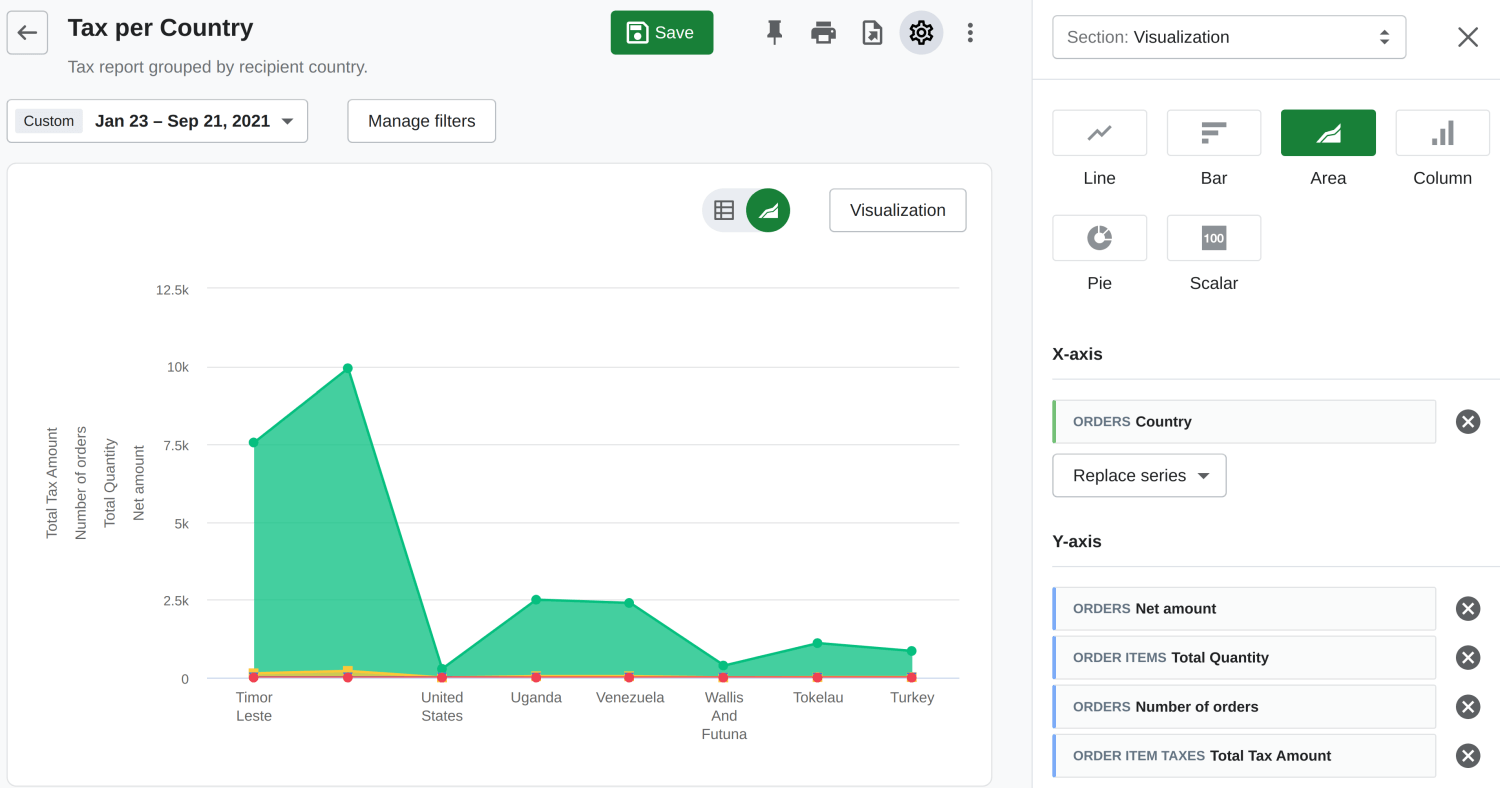

Tax Per Country - similar to the previous report, but instead of the State / Province of the recipient, the Country receives the report.

| OrdersCountry | OrdersNumber of orders | Order ItemsTotal Quantity | OrdersNet amount | Order Item TaxesTotal Tax Amount |

|---|---|---|---|---|

| United Kingdom | 51 | 213 | €4,577.58 | €0.00 |

| Belgium | 19 | 82 | €1,086.70 | €89.04 |

| Netherlands | 11 | 45 | €717.45 | €65.59 |

| Germany | 11 | 65 | €982.28 | €76.58 |

| Austria | 4 | 36 | €568.65 | €51.31 |

| Sweden | 1 | 4 | €89.46 | €4.07 |

| United States | 1 | 7 | €159.05 | €0.00 |

| Denmark | 1 | 9 | €191.91 | €9.94 |

| France | 1 | 2 | €41.48 | €1.81 |

| Italy | 1 | 9 | €174.92 | €11.43 |

| Poland | 1 | 2 | €63.98 | €2.71 |

| 102 | 474 | €8,653.46 | €312.48 |

Tax details. In this report, each sold variant is presented in a separate row. This way you can see absolutely all sales that are taxable. Use filters by the variant value or any other value in the data grid to reduce the number of displayed data entries.

| OrdersName | OrdersProcessed At | Order ItemsSKU | Order ItemsProduct Name | Order ItemsVariant Name | Order ItemsTotal Quantity | Order ItemsTotal Price | Order Item TaxesTitle | Order Item TaxesTotal Tax Amount |

|---|---|---|---|---|---|---|---|---|

| #1602 | May 10, 2022 12:29 AM | LMXS | Stretch Short | LIME / XS | 1 | $48.00 | CA COUNTY TAX | $0.12 |

| #1602 | May 10, 2022 12:29 AM | LMXS | Stretch Short | LIME / XS | 1 | $48.00 | CA STATE TAX | $2.88 |

| #1602 | May 10, 2022 12:29 AM | LMXS | Stretch Short | LIME / XS | 1 | $48.00 | LOS ANGELES CO LOCAL TAX SL | $0.48 |

| #1602 | May 10, 2022 12:29 AM | LMXS | Stretch Short | LIME / XS | 1 | $48.00 | LOS ANGELES COUNTY DISTRICT TAX SP | $1.08 |

| #1602 | May 10, 2022 12:29 AM | GRNXS | Stretch Short | GREEN / XS | 1 | $48.00 | CA COUNTY TAX | $0.12 |

| #1602 | May 10, 2022 12:29 AM | GRNXS | Stretch Short | GREEN / XS | 1 | $48.00 | CA STATE TAX | $2.88 |

| #1602 | May 10, 2022 12:29 AM | GRNXS | Stretch Short | GREEN / XS | 1 | $48.00 | LOS ANGELES CO LOCAL TAX SL | $0.48 |

| #1602 | May 10, 2022 12:29 AM | GRNXS | Stretch Short | GREEN / XS | 1 | $48.00 | LOS ANGELES COUNTY DISTRICT TAX SP | $1.08 |

| #1120 | May 10, 2022 7:22 AM | RSS | Stretch Short | ROSE / S | 1 | $48.00 | AZ CITY TAX | $0.86 |

| #1120 | May 10, 2022 7:22 AM | RSS | Stretch Short | ROSE / S | 1 | $48.00 | AZ COUNTY TAX | $0.00 |

| #1120 | May 10, 2022 7:22 AM | RSS | Stretch Short | ROSE / S | 1 | $48.00 | AZ STATE TAX | $2.69 |

| #1120 | May 10, 2022 7:22 AM | BLS | Stretch Short | BLACK / S | 1 | $48.00 | AZ CITY TAX | $0.86 |

| #1120 | May 10, 2022 7:22 AM | BLS | Stretch Short | BLACK / S | 1 | $48.00 | AZ COUNTY TAX | $0.00 |

| #1120 | May 10, 2022 7:22 AM | BLS | Stretch Short | BLACK / S | 1 | $48.00 | AZ STATE TAX | $2.69 |

| #1126 | May 10, 2022 8:33 AM | BLKXS | Stretch Short | BLACK / XS | 1 | $48.00 | NY COUNTY TAX | $2.04 |

| #1126 | May 10, 2022 8:33 AM | BLKXS | Stretch Short | BLACK / XS | 1 | $48.00 | NY SPECIAL TAX | $0.18 |

| #1126 | May 10, 2022 8:33 AM | BLKXS | Stretch Short | BLACK / XS | 1 | $48.00 | NY STATE TAX | $0.00 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | CA CITY TAX | $0.43 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | CA COUNTY TAX | $0.11 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | CA STATE TAX | $2.59 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | LOS ANGELES CO LOCAL TAX SL | $0.43 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | LOS ANGELES COUNTY DISTRICT TAX SP | $0.97 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | CA CITY TAX | $0.48 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | CA COUNTY TAX | $0.12 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | CA STATE TAX | $2.88 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | LOS ANGELES CO LOCAL TAX SL | $0.48 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | ORANGE COUNTY DISTRICT TAX SP | $0.24 |

| #1634 | May 10, 2022 11:53 AM | HYDM | Stretch Short | BLUE / M | 1 | $48.00 | OH COUNTY TAX | $0.84 |

| #1634 | May 10, 2022 11:53 AM | HYDM | Stretch Short | BLUE / M | 1 | $48.00 | OH STATE TAX | $2.35 |

| #1639 | May 10, 2022 12:25 PM | BLM | Stretch Short | BLACK / M | 1 | $48.00 | MI STATE TAX | $2.30 |

| #1642 | May 10, 2022 12:38 PM | BLM | Stretch Short | BLACK / M | 1 | $48.00 | MI STATE TAX | $2.88 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 30 | $1,440.00 | $81.82 |

The Tax Collected (Monthly) report is similar to the default Shopify tax report. It provides data on the orders and their taxes. However, in comparison to the default Shopify reporting functionality, our app provides more flexibility with filters and the ability to edit data columns.

Advanced Reports app also provides extended functionality on report export. You can export data as Microsoft Excel (.xlsx), PDF document (.pdf), web page (.html), comma-separated values (.csv). Export to Google Sheets is also supported.

Data visualization is also enhanced in Advanced Reports app when creating a Shopify tax report. You can build graphics in the form of a line chart, bar, area, column, pie, scalar. Add several data columns as Y-axis to make the graphic visualization more informative.

In addition to the preinstalled reports, you can also easily create custom reports tailored to custom requirements. For example, show detailed taxes but with a filter for a specific state. Or exclude unnecessary countries from the report.

Read more about how to create custom reports, manage filters, add data columns in Advanced Reports on the help page of this app.

Unfortunately, no. The system can’t collect sales taxes automatically because the process has different rules. As a store owner, you must decide on your own when it is appropriate to collect sales tax. However, Shopify does calculate sales tax for purchases if you set it in settings. You may also use the Shopify Tax’s liability insights. It will show you the rules for tax collection for each US state.

Once again, no. It is your responsibility as a store owner to deal with your taxes. You must contact your local authority to register your business and then file taxes as expected in your region. Shopify may automate many tasks, but taxation processes are too important and have too many rules to leave to the system.

It depends on your business practices. For example, if you are a sole proprietor or use a single-person LLC, you must file a “Schedule C with Form 1040”. Or you may need to fill out the “Form 1120” if you wield a corporation-scale business. However, as stated in the previous question, Shopify will not pay taxes for you, so the system does not require these documents. You must deal with taxes yourself, working directly with the authority.

Shopify system does not file or report sales taxes automatically. You must go through filing and sending the appropriate form independently. However, if you need information about taxes related to the customers’ orders, Shopify reports can help. Three reports can show you taxation information: “US sales tax report”, “Taxes finance report”, and “Sales finance report”. And if you need to know how to add sales tax on Shopify, see one of the next questions.

Generally speaking, yes. However, you must contact your local authorities for detailed information. Most regions, like the US, Canada, the UK, and the European Union, have certain sales tax rules that you must follow to avoid legal problems. Shopify may help you automate tax charging for sales.

Shopify cannot remit taxes for you. However, we can tell you how to file taxes for Shopify store. To set up automatic taxation, go to your admin panel and open the “Setting” and “Taxes and Duties” tab. There will be a “Manage sales tax collection” section where you can select your geographical region. Next, click the “Collect sales tax” button and fill in the needed information, like a tax number. Finally, click the “Collect tax” button.

There are, in fact, many apps that can help you deal with sales taxes. For example, our Advanced Reports app lets you see more relevant information about your transactions, orders, and tax rates. With this data at your disposal, filing taxes may be greatly simplified.

We want to provide value for all our customers. Start with a call to discover how we can help your business.